When I was talking to my cousin about my Dad’s estate, she said that things are a lot easier if there are less than $100K in assets. I laughed it off, knowing that my Dad’s house alone would blow past that amount. But then I dug deeper.

Next in Line

The key to planning for your death is designating who is next in line. You want to name clear beneficiaries for as many of your possessions as possible. There are multiple ways to do this, and the first is by creating a trust. Think of a trust like a bucket where you can place your home, financial accounts, vehicles, and other assets of significant value.

You can also simply name beneficiaries on your financial accounts. I was marked as “ITF” or “In Trust For” on my father’s two checking accounts. This means that those two accounts immediately became mine upon my Dad’s death.

Financial firms like Fidelity also allow you to designate beneficiaries for each account. My father had my brother and me marked as 50% beneficiaries. We had a meeting with Fidelity to get the accounts split and transferred into our names.

What If You Don’t?

I think the reason I haven’t been too concerned about a will or a trust is that it’s very clear if I were to die, my spouse would inherit everything. If we were both to die, then the kids would split everything 50/50. This is really all my Mom and Dad’s will stated. And this is how it will work if you don’t have a will. However, everything will have to go through probate.

Probate is the legal process that decides how an estate’s assets are handled after death. If you have minors, this process can become a lot trickier, as they are not old enough to own a home or vehicles. Going through probate means weeks, if not months, of paperwork and lawyers to decide what could have been settled with a simple will.

Also, you most likely aren’t going to include literally everything in a trust or will. You would need to be constantly updating it whenever you made any purchases. That’s where the Small Estate Affidavit comes into play.

The Small Estate Affidavit

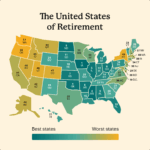

Every state has a different limit, so you need to be aware of your state’s laws. In Illinois, this limit is $100,000.

If assets that need to go through probate (unclear beneficiaries) total less than this amount, then you do not need to go through the probate process. All you need to do is fill out a form (Small Estate Affidavit), sign it in front of a notary, and attach a certified copy of the death certificate.

You can now go to the DMV and have the title of the car transferred into your name. No court, no judges, and no lawyers.

If you are selling some expensive jewelry, the dealer might ask for the affidavit to ensure it is not stolen goods. But, in general, you shouldn’t need the affidavit for household items, as most people aren’t going to ask if you have the right to sell something.

My Recommendations

Get yourself a will and a trust. If you own a home, put it in the trust. Put any vehicles you own in the trust as well to help avoid reaching that $100K limit. For your financial accounts, name clear “Transfer on Death” (TOD) beneficiaries. If my father had more than one car or a boat, reaching $100K would not have been unthinkable. If you’re in a state with a smaller limit, this is even more important. A little planning goes a long way.